Yesterday I posted about the results of the Livingston Survey regarding the economic outlook for the U.S. I was surprised to find that the survey participants are also asked to forecast for the level of the S&P 500 for periods ranging up to 24 months ahead.

So, are economists any better than others at forecasting the stock market? Not really.

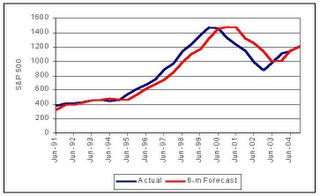

Due to data comparison problems, I only took a look at 6 and 12-month forecasts from 1990 onwards. The results are pretty clear, as can be seen in this graph:

Economists commit the same sin as the average investor: their forecasts are basically just extrapolations of recent trends. And even in periods where there were clear trends, these extrapolations were wide off the mark. For example, the level of stock prices was consistently underestimated in the 1990’s (not surprising given the bubble and their knowledge of long-term trends).

On average, there was a +/- 15% error margin for 6-month forecasts, which rose to +/- 20% in the 12–month horizon.

If you had trusted them to manage your money, say by allocating between stocks and bonds, you would’ve had terrible results. That’s perhaps the reason that on Wall Street economists are mostly confined to the safety of research departments.

Thursday, June 09, 2005

Forecasting stocks

Posted by

Andrés

at

12:09 PM

![]()

Subscribe to:

Comment Feed (RSS)

|