As a science dunce who has trouble telling his electrons form his photons, I'm not qualified to disucuss the debate concerning global warming. But when insurers --more concerned with odds rather than politics--express their worries in public, it's a sure sign that it's for real.

Wednesday, June 29, 2005

Friday, June 24, 2005

A very vicious circle

The Buttonwood column at The Economist lays it out very cleary.

Companies and asset managers have tended to take a laid-back approach to pension underfunding, relying on the markets to right things as they often have before. What is worrying about the latest numbers is that we are seeing them towards the end of a period of strong economic growth and corporate profitability, neither of which is likely to continue. John Mauldin, an investment consultant, calculated in a recent column that total portfolio returns over the next ten years were likely to be around 5%, far less than the 8-9% projected by most funds. He reckoned that the total shortfall in America could be somewhere between $500 billion and $750 billion. And that is without counting companies’ promises to provide health care to employees and retired workers. Nicholas Colas at Rochdale Research, an independent firm, calls these obligations a bigger problem than pensions because they are neither funded nor insured.

There are a couple of weird circularities here. Most of the burden of filling these gaps will fall on the companies themselves, which will depress their profits. That, in turn, will depress share prices, which will make it harder to achieve adequate investment returns. And if asset managers turn en masse to bonds with long maturities to match their assets and liabilities more precisely, which is necessary especially for older plans, that will raise bond prices, depress bond yields and increase the present value of assets they must hold—again, widening the pensions gap. They could, of course, look to other asset classes that pay higher or “absolute” returns (hedge funds of funds, private equity, property) and many are doing so. But “alternative” assets do not typically account for more than one-tenth of the total portfolio, in part because they are labour-intensive to manage.

A the column spells out, there is a huge funding gap and no one –firms, workers, taxpayers, shareholders—wants to end up holding this hot potato.

I’m not an expert on this subject, but I believe it’s likely that that the burden will fall on the weakest link: shareholders, who as always have the largest collective action problem. How so? Well, one solution will be to “capitalize” the pension obligations by swapping the funding obligations for shares. This basically implies, for example, that the United Auto Workers will end up owning General Motors and Ford.

Maybe this is a non-starter under conditions in the United States. But I believe this “solution” is feasible in may contexts. For example, most state-owned firms in emerging economies have pension deficits that make the funding gap in the U.S. or other developed nations look like child’s play. Governments are often very eager to privatize those firms to avoid the inevitable rescue package that will bust the treasury, but unions are adamantly opposed. So, in the end, the likeliest bargain will be to transfer ownership to the workers.

Posted by

Andrés

at

11:05 AM

|

![]()

Tuesday, June 21, 2005

Oil gone wild

It’s rather remarkable how the markets have reacted to oil at nearly 60 dollars per barrel, just four weeks after dropping to 47 dollars per barrel: stock prices have risen on average and bond yields have stayed put.

The good news is that high and rising oil prices are usually a sign of strong growth in the world economy, which of course is most welcome.

The bad news is that we’re entering dangerous territory and no one seems to know what’s really going on.

Some analysts, such as Andy Xie over at Morgan Stanley, explain away the jump in oil prices as the consequence of rampant “speculation”. They argue that slower growth and the rising output of petroleum substitutes will cause a dramatic collapse in oil prices in the near future.

Obviously, “speculation” is an oft misused and abused word, but there’s some evidence to back this point of view. For one, it’s hard to reconcile oil at record price levels with inventories at 5-year highs in the U.S.. And let’s not forget that neither the demand or supply outlook has changed over the last few weeks.

Yet, the fact remains that spare capacity is low and demand in the U.S. and the Asia Pacific region is still very strong. (By the way, I don’t buy the capacity-constraints-at-refineries argument: heavy crudes have risen as much in value as light crudes).

Things get even weirder at a more fundamental level. While many insist that oil production will keep on rising for quite a while, the “peak oil” movement loudly argues otherwise.

Regardless of who’s right, one has to wonder what impact energy prices at this level will have on the world economy. Sure, it’s dodged the bullet so far, but it’s possible if that the price of oil crosses-a certain threshold—obviously unknown—the impact will be severe.

Where does that leave mere mortals like me? Well, if I have to trust anyone, it’d be the price mechanism, which is signaling strong demand and high prices for the foreseeable future. However, for investment purposes, I’d use fairly conservative assumptions: my long-term guess is that oil will average around 40 dollars per barrel over the next few years. And, yes, high prices will take their toll on output over the next few months.

Posted by

Andrés

at

2:48 PM

|

![]()

Thursday, June 16, 2005

Bin travelin'

Sorry for not posting, but I've been travelling a bit in the U.S. on business. As always, it's a pleasure to be here (Southern California), although the weather has not been very cooperative (cloudy and cool).

With a patchy net connection, I've indulged in watching local TV. All the advertising by lawyers never ceases to amaze me or any other foreigner for that matter. According to this article, it totals around 500 million a year, most of it spent on television. That's about 499 million more than lawyers spend in the rest of the world.

And speaking of being overlawyered, on a visit to a residential compound I asked an employee what kind of people lived there (I was thinking along the lines of singles/married couples with kids). With a straight face, he stated that he couldn't answer for legal reasons (apparently some sort of non-discrimination statute).

Yet, you can find very, very detailed data that breaks down enrollment by ethnic/racial group and their respective standarized test scores.

So, you can't ask about what neighbors you'll have (something you can easily find out just by hanging out a while), but you can precisely tell who your children will study with. That's weird and wonderful America for you.

Posted by

Andrés

at

3:32 AM

|

![]()

Saturday, June 11, 2005

Anarchy and cell phones

The emerging nations of this world are a strange mixture of pockets of modernity and large areas of abject poverty. This sets the stage for some truly amazing, heartbreaking stories. Take this one from the latest issue of The Economist:

Veronique, an office worker, was separated from her daughter by the war. When peace broke out, she booked an aeroplane ticket for her (penniless) girl to rejoin her. But before the daughter could board the plane, she was detained. Her yellow fever vaccination card had been stamped by rebel health authorities, and so was invalid, the officials tut-tutted. Alas, she had no money for a bribe.

But Veronique was able to send her the equivalent of cash by mobile telephone. She bought $20 worth of telephone cards. These give you a code number which you key into your phone and thereby “recharge” it with pre-paid airtime. Veronique called the obstructive officials and gave them her code numbers to recharge their own mobile phones. It took only minutes to send her bribe across the country—faster than a bank transfer, which would in any case have been impossible, since there is no proper banking system.

That's Congo. Private cellphone networks and private airlines work because the landlines do not and the bush has eaten the roads. Public servants serve mostly to make life difficult for the public, in the hope of squeezing some cash out of them. Congo is a police state, but without the benefits. The police have unchecked powers, but provide little security. Your correspondent needed three separate permits to visit the railway station in Kinshasa, where he was stopped and questioned six times in 45 minutes. Yet he found that all the seats, windows and light fixtures had been stolen from the trains.

If only Joseph Conrad were alive today.

The Congo is obviously an extreme, tragic case. But even for more "developed" emerging nations, true prosperity and stability remain elusive, even nearly 200 years after independence, as is the case of Latin America. Just look at Bolivia. I don't want to be a pessimist, but even well-meaning initiatives such as debt relief are not going to make a real difference unless the politics of the these countries can be fixed.

Posted by

Andrés

at

6:43 PM

|

![]()

Thursday, June 09, 2005

Forecasting stocks

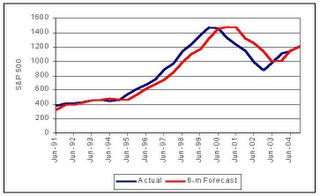

Yesterday I posted about the results of the Livingston Survey regarding the economic outlook for the U.S. I was surprised to find that the survey participants are also asked to forecast for the level of the S&P 500 for periods ranging up to 24 months ahead.

So, are economists any better than others at forecasting the stock market? Not really.

Due to data comparison problems, I only took a look at 6 and 12-month forecasts from 1990 onwards. The results are pretty clear, as can be seen in this graph:

Economists commit the same sin as the average investor: their forecasts are basically just extrapolations of recent trends. And even in periods where there were clear trends, these extrapolations were wide off the mark. For example, the level of stock prices was consistently underestimated in the 1990’s (not surprising given the bubble and their knowledge of long-term trends).

On average, there was a +/- 15% error margin for 6-month forecasts, which rose to +/- 20% in the 12–month horizon.

If you had trusted them to manage your money, say by allocating between stocks and bonds, you would’ve had terrible results. That’s perhaps the reason that on Wall Street economists are mostly confined to the safety of research departments.

Posted by

Andrés

at

12:09 PM

|

![]()

Wednesday, June 08, 2005

Want to know what economists are thinking?

Just go and check out the results of the Livingston Survey, the oldest continous survey of U.S. economic forecasts (in business since 1946). Reuters has a good summary here.

The results are very similar to the ones I described a few days ago (based on a Federal Reserve survey): growth will stay over 3% and inflation will average 2.5% over the next ten years. Thus, economists see long-term interest rates rising to 5% as early as next year.

Needless to say, the bond market begs to differ. Only time will tell who's right.

Posted by

Andrés

at

7:32 PM

|

![]()

Of spreads and stocks

As if the long-term rate conundrum weren’t enough, I’m afraid we have another puzzle on our hands, this time related to the behavior of bond spreads and stock prices.

Spreads –in this case the difference between the yields of Baa-rated bonds and 10-year Treasuries--are usually high during recessions or periods of slow growth and tend to fall in more prosperous times. They aren’t correlated with the level of rates, but they do show a strong negative response to changes in rates: that is, spreads rise when rates fall and vice versa. The cause is clear: falling rates imply lower expected inflation, which in turn reflects slower growth in the economy and a lower earnings performance in firms.

The following graph shows normalized (i.e. long term average =1) 10-year yields and Baa spreads.

img src="http://photos1.blogger.com/img/31/6194/320/spreads.jpg">.

A few brief observations:

· After 2000, spreads went wild, reaching never before seen heights despite the fact that the 2001 recession was pretty mild. This probably reflects structurally higher leverage.

· Despite robust economic growth in 2004/2005, spreads are still pretty high relative to the long run average.

· As was to be expected, spreads have risen sharply in the past few weeks, in tandem with falling long-term rates.

· Spreads will only fall to long-term average levels if rates rise towards 5%.

The central message here is that the recent fall in rates is not good news, as it signals a weaker economy that will lower credit quality and raise the level of financial risk.

However, it’s worth noting that stocks in the U.S. have posted gains in the last two months, a period in which spreads rose sharply. Needless to say, this is contradictory: stocks usually move in the opposite direction of spreads.

So who’s right? I honestly wished I did. The only thing I do know is that we live in very uncertain times when traditional correlations are not working as expected. Hence, I’d have a very cautious investment policy. Cash anyone?

Posted by

Andrés

at

11:32 AM

|

![]()

Tuesday, June 07, 2005

Reading the Fed's tea leaves

Like the Kremlinologists of yore, central bank watchers are always tempted to read between the lines and derive meaning from seemingly inconsequential remarks. Well, at least that's how I feel today. It seems everyone else (see here) is reading Greenspan's remarks in a different light than yours truly. I believe he might be signalling that short and long term rates were bound to rise in the none-too-distant-future, while others see these comments as a sign that rates will be low for quite some time.

We'll know more soon, as Greenspan is set to testify before Congress later this week.

Posted by

Andrés

at

10:46 AM

|

![]()

Monday, June 06, 2005

Does Greenspan have a hidden agenda?

Alan Greenspan is still puzzled by the low level of long-term interest rates. In these remarks, published today, he goes over some of the hypotheses commonly mentioned: pension fund adjustments, Asian central bank purchases of U.S. bonds, expectations of an economic downturn and lower inflation expectations due to globalization. He finds them all wanting.

So, believe it or not, the world's foremost central banker doesn't know what factors are driving long-term rates lower. It seems rather absurd. He could've at least had the decency of offering his own ideas. This, in its way, is both revealing and suggestive.

My guess is that he's singalling in a very subtle way that long-term rates should be higher. I can think of two reasons (non-exclusive) for this.

First of all, given last Friday's weak employment numbers, many investors are expecting that short-term rates won't rise much more, if at all. If the Fed surprises by hiking them --or signalling to that end--more than expected, then all those people buying 10-year Treasuries at 3.9% are in for a very nasty shock, which may create instability (1994 all over again, only with a lot more leverage).

This scenario is not far-fetched. Richard Berner of Morgan Stanley argues here that the markets are underestimating the economy's strength and the that inflation will keep rising. He sees the Federal funds rate rising to 4%.

Alternatively, Greenspan may like rates to be higher to dampen some of the economy's flashpoints: the huge current account deficit, the real estate froth/bubble, some of the wilder hedge funds, etc. To a lesser or greater extent, all pose a significant risk.

If long-term rates don't rise significantly over the next few weeks, it's likely that the Maestro will be more explicit, perhaps even offering 'tentative' explanations to his 'conundrum'.

Posted by

Andrés

at

8:24 PM

|

![]()

Best bet among the oil majors?

Lately, I’ve been doing a bit of researching Big Oil. At first glance, it looks like ExxonMobil –the biggest private energy firm—is doing best, by far. Over the last 12 months its stock has been the top performer in this group and it enjoys the highest valuation by any measure. .

.

Seeing this, I was sure its operating figures must be much better than those of other (such as BP, Shell and Total). But digging deeper, this proved to be very, very false: Exxon has some of the worst figures in the industry.

For instance, take production. According to my calculations, its total oil & gas output has fallen over the last four years (by 1.5%), while BP raised it by 23% and Total by 22%. Reserves, refining and product sales point the same way.

Yes, it’s generating tons of cash for shareholders (nearly 16 billion between dividends and repurchases last year). But this also reflects the fact that it invests much less than its competitors: Exxon’s capital expenditures only took up 30% of its operating cash flow (net income + depreciation), while the other firms invest over 50%.

So, we’re talking about a firm that is basically not growing in real terms, that is probably shortchanging its future by underinvesting and whose stock is pretty expensive.

This makes me wonder whether I’m the only one missing something or most everyone else is in the dark. Well, for what its worth, I believe Total is the best choice in this group, followed by BP.

Posted by

Andrés

at

5:44 PM

|

![]()

Friday, June 03, 2005

Geezers-4-Bonds?

One of the arguments to justify the current low level of long-term bond yields is demography. In the developed world, the number of over 65’s is set to rise dramatically and this group will invest their savings mainly in bonds and other fixed-income instruments.

Sounds like plain common sense. Stocks are an uncertain investment in the short and medium (less than 10 years) and people over 65 years shouldn’t be fooling around with that kind of risk.. However, people don’t always behave or invest rationally.

Take the 2001 Survey of Consumer Finances, carried out by the Federal Reserve. It shows that 21% of families whose head has over 65 years of age have direct holdings of stock, basically the same proportion as the total population. In the over 75 years group, these holdings amount to 27% of all financial assets, the highest proportion of any age group.

Taking only identifiable financial assets (meaning those that are not managed by others, such as mutual funds, retirement funds, life insurance, etc.), it turns out that directly-held stocks represent around 50% of that total in the geezers’ case, a similar proportion to other age groups.

Obviously, this data set has limitations. It’s impossible to break down managed assets by type of investment, so its possible that these holdings will be increasingly oriented to bonds. Nonetheless, the main point stands: old people are not noticeably less risk-averse in their investment choices.

It’s something I’ve seen all too often. I have relatives who still play the market well after retirement age. One was even suckered into investing in tech stocks at the height of the dot com bubble. Greed doesn’t decline with age.

Research seems to back the argument that demography plays a modest role in total and relative demand for different types of assets (see this paper). Actually, if you want to profit from the geezerification of the world, read this study (hint: the secret is in the sectors).

Posted by

Andrés

at

1:04 PM

|

![]()

More on rates

People are seriously confused. While most economists still see long-term intereset rates rising towards 5%, other predict yields as low as 2.5% in the fairly near future. To get a feel for this, be sure to check out this column. As was to be expecteded, history has been dragged into the debate. Many analysts are now arguing that high rates (meaning above 10%) are an aberration, since they were very low before the inflationary 1970's. (Which does not really mean anything, since the world today bears little resemblance to times past.)

This is verily the mystery of the moment. Definitely worth looking into.

P.S. Where do you head for bond info? Look to Bondnheads, naturally.

Posted by

Andrés

at

12:46 AM

|

![]()

Thursday, June 02, 2005

The real interest rate puzzle

Alan Greenspan famously puzzled over why long-term interest rates were so low when the 10-year T bond was yielding well over 4%. Today, its yield stands at 3.9%.

Lots of possible explanations have been offered (check this post). Many are based on short and medium term trends, such as yields driven down by massive foreign purchases of U.S. bonds. This basically implies that rates will rise as soon as these trends run their course, which is anybody’s guess. Another theory emphasizes that Mr. Bond Market (of James Carville fame) sees growth slowing down drastically over the next decade, which in turn will lead to persistent low inflation. That's the position held by Kash.

To clear things up a bit, it’s worth taking a look at what forecasters have to say. This Fed survey presents interesting results. The 2nd quarter forecasts see 10-year T bond rates rising to a bit over 5% in early 2006, with GDP growth slowing to 3.3% next year and inflation averaging around 2.4%.

These figures are actually very similar to the long-term forecasts (for the next ten years) made once a year, in the first quarter. Forecasters see 10-year rates averaging 5% in this period, with GDP growth at 3.3% and inflation of 2.5% over this period.

What does this mean? Once again, there are many possible interpretations. One is that short-term factors are temporarily depressing yields, which will shortly rise to 5%. The obvious problem here is, of course, that they’ve been forecasting a rise to 5% for several years and it ain’t happened.

Given that long-term inflation expectations have held very steady, it seems that the factor that has really driven long-term rates is the real rate. These forecast think it’ll average nearly 2.5% annually, but Treasury inflation-linked bonds have put it at a bit above 1.6%.

This is the real puzzle. Usually, expected long-term real rates have been a tad higher than expected real GDP growth (around 3%). That began to change in 2001, when growth forecasts exceeded expected real bond returns, a gap that has widened dramatically since last year, as it currently stands at a yawning 200 basis points.

Sounds like something has to give: either real rates will rise or long-term growth expectations have to drop.

More on this topic later, but all comments and suggestions are very welcome.

Posted by

Andrés

at

10:54 AM

|

![]()

Wednesday, June 01, 2005

Original name prize

They'd have to give it to Fat Prophets, an independent equity research firm in Australia. I love it.

Posted by

Andrés

at

1:05 PM

|

![]()