No, I'm not thinking of George W. Bush right now. Guess which long-standing national leader uttered this infamous phrase recently:

"Where money for projects has not been found, we will print it," xxx was quoted as saying.

The answer is: Robert Mugabe of Zimbabwe. Not surprisingly, inflation in that country, currently over 4,500% a year, is going to infinity and beyond. If I were a betting man, I'd wager Mugabe's regime will collapse in less than a year.

If you're interested in why Zimbabwe technically got into this mess, check out this paper.

Sunday, July 29, 2007

How inept can a ruler be?

Posted by

Andrés

at

10:29 PM

|

![]()

Thursday, July 26, 2007

Economic tortoise, financial hare

Other than in soccer, Latin America has (mostly) lagged behind (east) Asia in nearly all indicators, specially in terms of economic growth. But, as BCA Research recently noted, Latin American stocks have outperformed their Asian peers by a wide margin over the last 20 years. Capital Spectator looks at some explanations, but finds no clear answer.

Actually, there's a pretty simple explanation.

In the 1980's, Latin America was stuck in a huge economic and financial crisis after many nations defaulted on their foreign debt and commodity prices plunged. At the same time, the Asian Tigers were roaring along quite nicely. Hence, Latin American stocks at that time had very high risk premiums incorporated into their valuations. Those risk premiums have fallen dramatically as LA has put its finances in order during this time frame. Thus, starting from a lower base, the region's stocks have outperformed.

One could aslo add that the LA sector is dominated by a few fantastically profitable monopolies/oligopolies and that Asian markets were and are much more liquid, so that a falling liquidity premium might be helping LA stocks.

Posted by

Andrés

at

6:18 PM

|

![]()

Contagion in the credit markets?

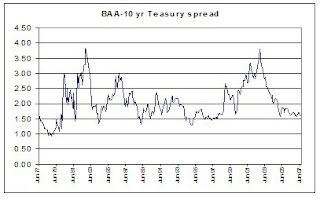

The markets were once again singin' the ol' sup-prime mortgage blues today. However, I believe that fears of a meltdown in the credit markets are way overblown. For one, corporate balance sheets are pretty healthy after years of record-high profits and modest leverage. In fact, spreads between BAA corporates and Treasuries have stayed pretty stable (however, I don't have data for the past couple of days).

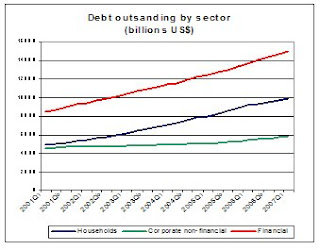

The real problem lies with consumers and certain financial firms, where leverage has grown strongly, as this graph shows.

Outside the financial sector, my one big worry is what impact falling home prices will have on consumers. So far, American consumers have, as always, withstood the storm. But for how long? Only time will tell, but in the meantime I'd avoid stocks exposed to U.S. consumer demand.

Posted by

Andrés

at

4:26 PM

|

![]()

Tuesday, July 24, 2007

A bubble in emerging market stocks?

This graph says yes. It compares the evolution of the Nasdaq Composite between June 1994 and June 1999 and the MSCI Emerging Markets index between June 2002 and June 2007.

We know how the Nasdaq story played out after a few more months of spectacular rises. But appearances can deceive. The main difference between these two? The Nasdaq's P/E was well north of 100x at its peak, while the P/E for emerging markets as a whole is around 15x today.

Of course, this doesn't guarantee that emerging market stocks are a good investment opportunity today, but at least they're not obviously overvalued.

Posted by

Andrés

at

1:20 PM

|

![]()